Group health insurance is a complex and ever changing landscape.

As businesses strive to provide affordable coverage for their employees, they must also contend with rising costs, new regulations, and a host of other challenges.

In order to navigate this complex landscape, businesses need to partner with a health insurance broker who can help them understand their options and find the best coverage for their needs. A good broker will have a deep understanding of the business health insurance market and will be able to help businesses find the right plan for their employees.

The following case study will explore the complexities of group health insurance and how a major company like Deliveroo was able to find the right coverage for their employees leveraging Bayzat’s innovative insurtech offering.

We spoke with Preethi Thomas, People Business Partner for the Middle East at Deliveroo as she provides her insight on how Bayzat’s insurtech is helping the company provide their employees with policies that fits their team's needs.

The following case study will explore the complexities of group health insurance and how a major company like Deliveroo was able to find the right coverage for their employees leveraging Bayzat’s innovative insurtech offering.

We spoke with Preethi Thomas, People Business Partner for the Middle East at Deliveroo as she provides her insight on how Bayzat’s insurtech is helping the company provide their employees with policies that fits their team's needs.

As a result of the recent digital transformation brought on by the new way we now work and the pandemic, what impact has this had on your policy management?

Previously we really didn't have a lot of structure, which means when I started off working with our insurance policies, documents were not stored in a very structured manner and we didn't have correct data on joiners and leavers.

But by using Bayzat’s platform it has become a lot easier to track and record these moving parts and there is now a lot more structure, the ease of handling data has improved and has visibility to what we’re doing.

This gives us an ease of mind that we can pick up from where we left off in terms of our employees so this is exactly what this transformation is about in terms of handling our data and insurance policy.

Previously we really didn't have a lot of structure, which means when I started off working with our insurance policies, documents were not stored in a very structured manner and we didn't have correct data on joiners and leavers.

But by using Bayzat’s platform it has become a lot easier to track and record these moving parts and there is now a lot more structure, the ease of handling data has improved and has visibility to what we’re doing.

This gives us an ease of mind that we can pick up from where we left off in terms of our employees so this is exactly what this transformation is about in terms of handling our data and insurance policy.

What kind of key challenges has using Bayzat’s insurtech helped solve for you?

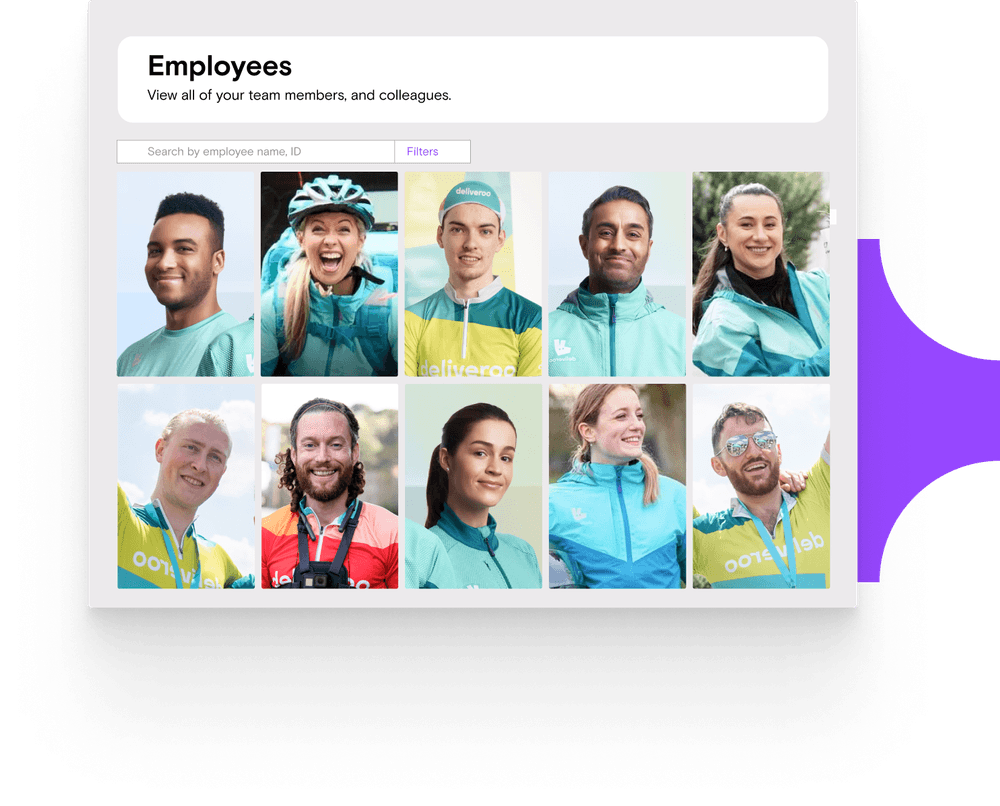

I think it's the enhanced visibility, especially during the enrollment of new employees. As a startup, it means we have a lot of employees that come in but as is the norm for tech startups there is some attrition, so when that occurs, keeping track of this would be difficult when using multiple Excel sheets, files and different forms.

With Bayzat it became a lot easier because now we have a platform we can directly go to. We can for example pull a list of people that are with us and we see immediately if that is not matching with the total number of employees we have in our HRMS system.

We can detect this pretty quickly and it is good for us to get on top of that, and fix those issues.

And another really distinct advantage is that speaking to a person is not something everyone is keen on, which is why this was a factor we deliberated over. As a business people have stopped wanting to call restaurants to order food, so we don't want to actually reach out to someone and bother them to help us with a certain task.

So I think having that removed from everyone's life is something that we needed.

I think it's the enhanced visibility, especially during the enrollment of new employees. As a startup, it means we have a lot of employees that come in but as is the norm for tech startups there is some attrition, so when that occurs, keeping track of this would be difficult when using multiple Excel sheets, files and different forms.

With Bayzat it became a lot easier because now we have a platform we can directly go to. We can for example pull a list of people that are with us and we see immediately if that is not matching with the total number of employees we have in our HRMS system.

We can detect this pretty quickly and it is good for us to get on top of that, and fix those issues.

And another really distinct advantage is that speaking to a person is not something everyone is keen on, which is why this was a factor we deliberated over. As a business people have stopped wanting to call restaurants to order food, so we don't want to actually reach out to someone and bother them to help us with a certain task.

So I think having that removed from everyone's life is something that we needed.

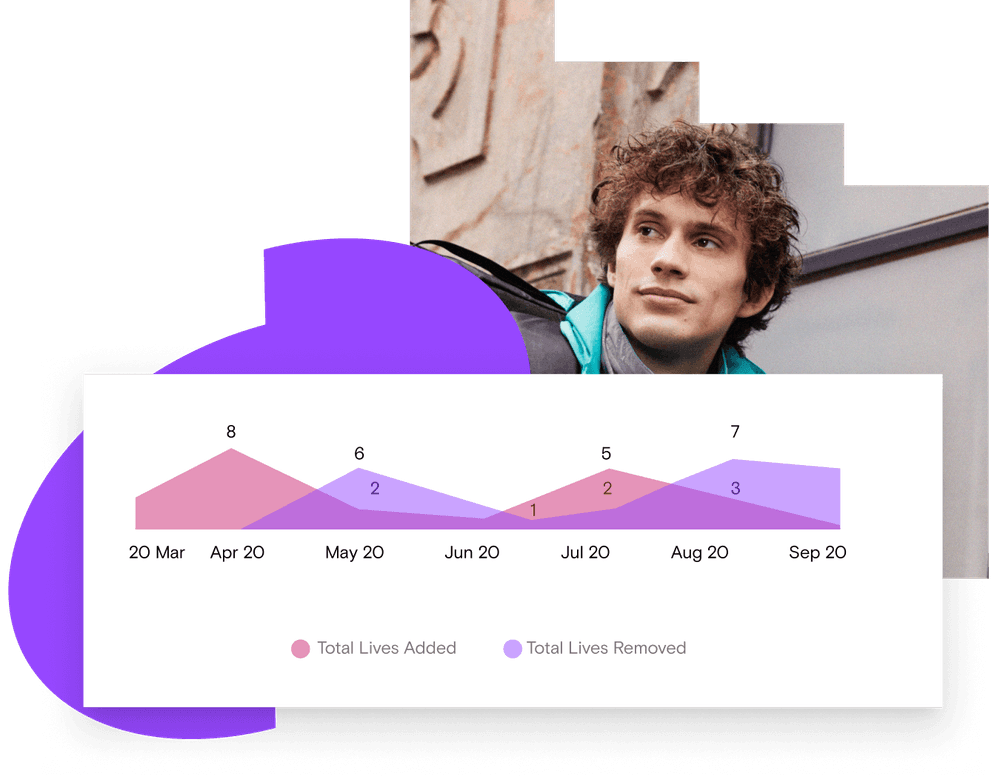

What benefits have Deliveroo derived from incorporating some of this data into the management process of your insurance policies?

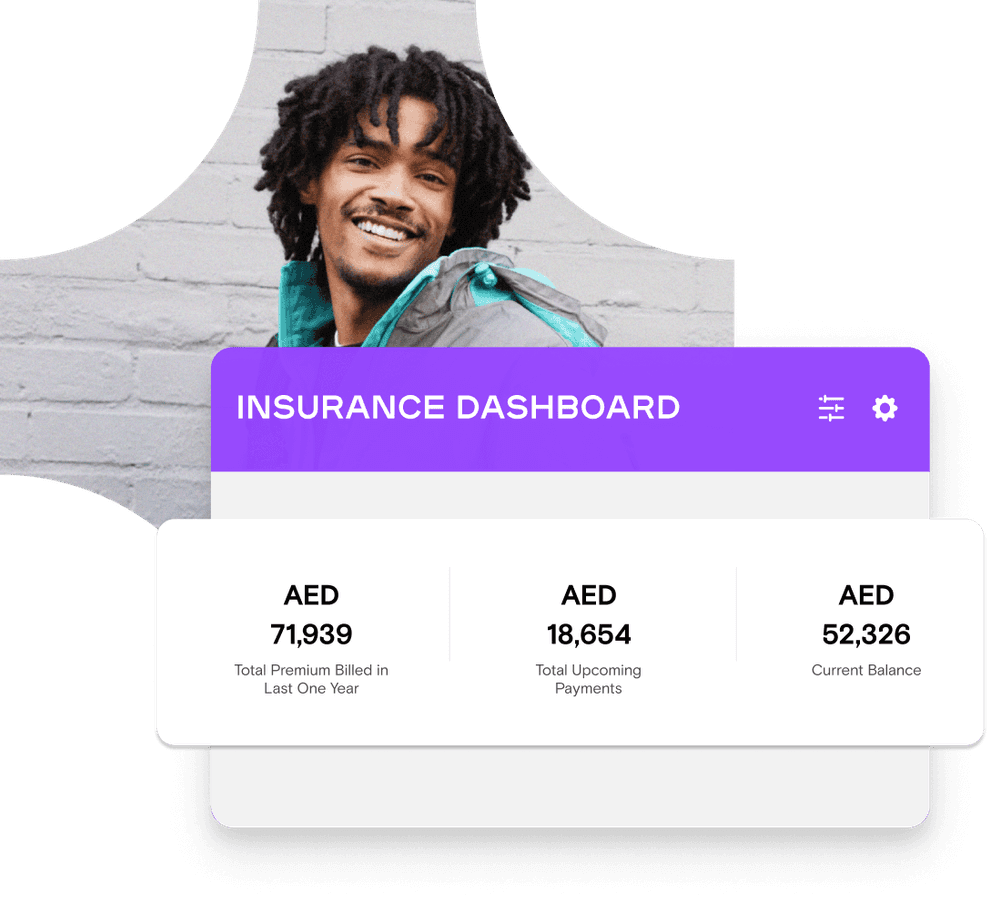

I think it's more so about budgeting. Especially because as an organization, we have two different policies, two different cycles. So it's better to see how much we are spending, how much more we are able to grow, how much our premiums have increased etc. Bayzat really helps us in terms of planning our finances.

The platform also helps in terms of understanding whether the policy that we have is actually beneficial. This is because we can compare our policies with others directly on the Bayzat platform.

In addition, if we have new joiners, we can see that X number of joiners have been added which means this is how much we have to pay in outstanding fees. We can see the prorated amount from the time employees join and how much we have to pay.

And this also gives us a greater understanding in the event a person leaves and we cancel their insurance policy, we have full visibility on how much gets credited back to us. The Bayzat platform really helps us understand and see where our money is going, where we may receive credits or refunds and ultimately it is all about having control and visibility which is really good.

I think it's more so about budgeting. Especially because as an organization, we have two different policies, two different cycles. So it's better to see how much we are spending, how much more we are able to grow, how much our premiums have increased etc. Bayzat really helps us in terms of planning our finances.

The platform also helps in terms of understanding whether the policy that we have is actually beneficial. This is because we can compare our policies with others directly on the Bayzat platform.

In addition, if we have new joiners, we can see that X number of joiners have been added which means this is how much we have to pay in outstanding fees. We can see the prorated amount from the time employees join and how much we have to pay.

And this also gives us a greater understanding in the event a person leaves and we cancel their insurance policy, we have full visibility on how much gets credited back to us. The Bayzat platform really helps us understand and see where our money is going, where we may receive credits or refunds and ultimately it is all about having control and visibility which is really good.

So you have seen tangible improvements financially using the platform?

Yes, exactly. We can keep track of payments, adding people accurately, are we getting the correct prorated amounts. We have a lot more visibility which is excellent for us.

Yes, exactly. We can keep track of payments, adding people accurately, are we getting the correct prorated amounts. We have a lot more visibility which is excellent for us.

From the employees perspective, have you seen any tangible results in their experiences on how they use the solution?

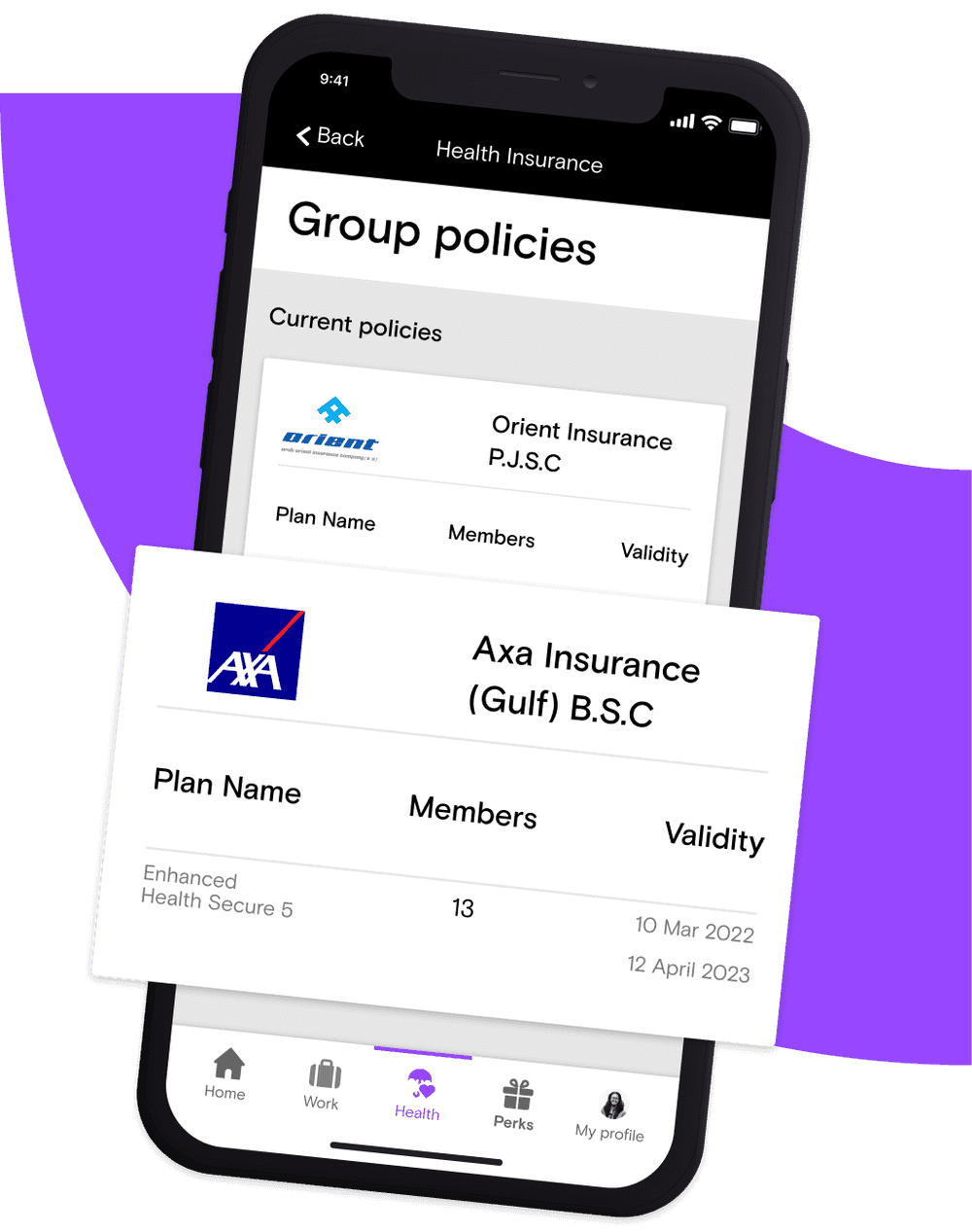

Oh, I'll tell you what! My experience is that I'm really liking the fact that a lot less employees are reaching out in terms of understanding their benefits, which is the most common question we had. Our employees only had their insurance cards and they really didn't know the benefits they were entitled to.

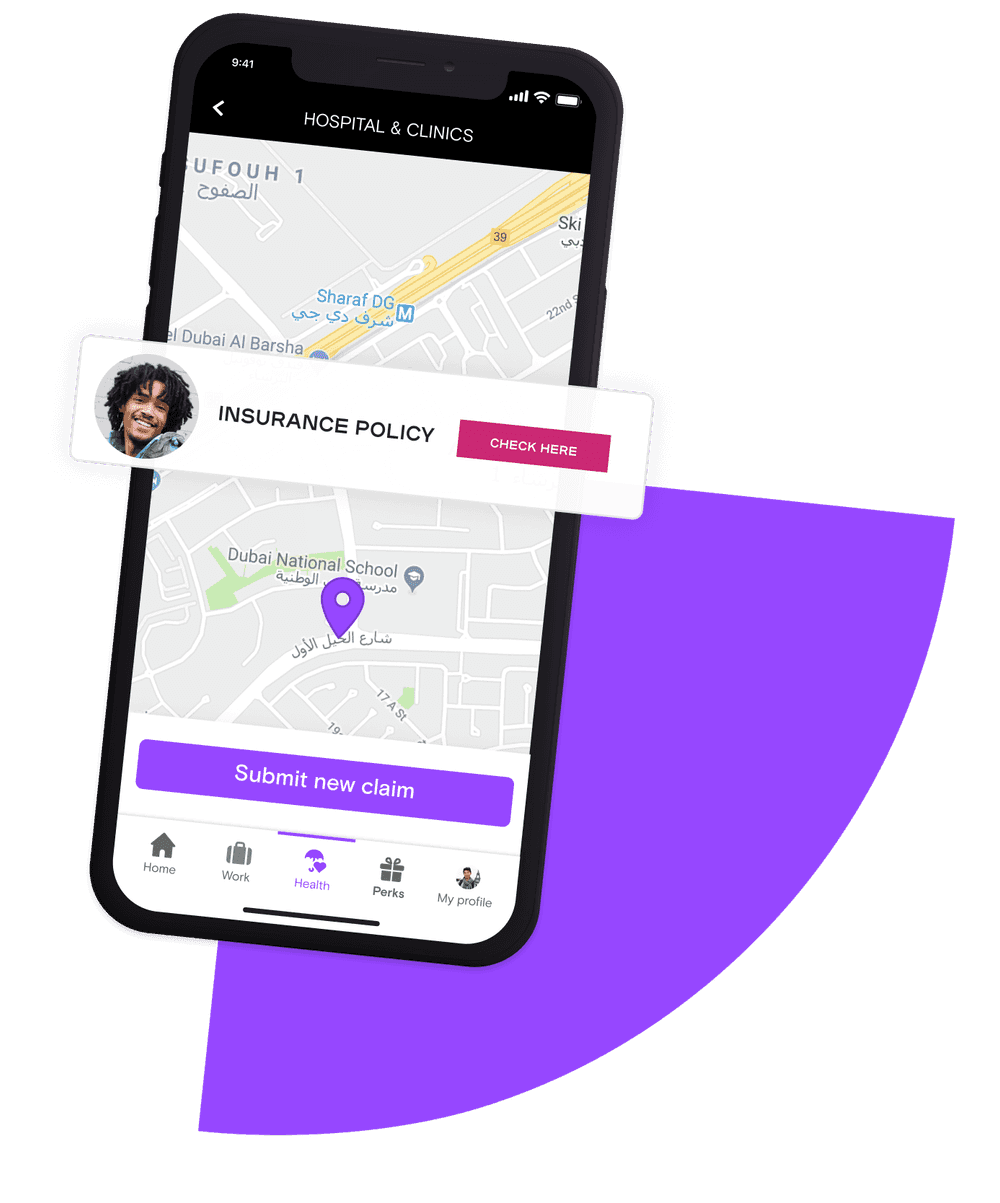

We would also always receive questions asking us about which hospitals to go to and which were covered in a given insurance policy. Prior to Bayzat we had very large Excel sheets where we would share this sort of information with our employees. So detailing all the hospitals they can go to and the contact details for each of those hospitals. But with Bayzat you can book your doctor or use your free online consultation from the app with ease.

There are a lot of options in the application and personally even though I work in HR, not having a middleman makes the experience a lot more comfortable for me. So if I don't have to go into the hospital reception, wait there and book a doctor’s appointment - that's a lot more comfortable for me.

And that's me as a user and an HR admin so I do see a huge decline in people asking me how to use their insurance policies and where their insurance cards are. That's helped a lot of our employees and I would say they're definitely happier having an understanding of what is covered, what is not covered, what is the policy, what the policy covers etc. So it works for us from a HR perspective, because there are fewer questions and it works for them because they themselves have a lot more visibility. So the entire process is much more streamlined. There is no back and forth. There are no repositories of information to send and then look through. And if they do have any issues there's a straightforward support email that we can reach out to which resolves our issues.

With everything sitting on the platform it’s very simple and if not, I can reach out directly to my representative so it's pretty good.

Oh, I'll tell you what! My experience is that I'm really liking the fact that a lot less employees are reaching out in terms of understanding their benefits, which is the most common question we had. Our employees only had their insurance cards and they really didn't know the benefits they were entitled to.

We would also always receive questions asking us about which hospitals to go to and which were covered in a given insurance policy. Prior to Bayzat we had very large Excel sheets where we would share this sort of information with our employees. So detailing all the hospitals they can go to and the contact details for each of those hospitals. But with Bayzat you can book your doctor or use your free online consultation from the app with ease.

There are a lot of options in the application and personally even though I work in HR, not having a middleman makes the experience a lot more comfortable for me. So if I don't have to go into the hospital reception, wait there and book a doctor’s appointment - that's a lot more comfortable for me.

And that's me as a user and an HR admin so I do see a huge decline in people asking me how to use their insurance policies and where their insurance cards are. That's helped a lot of our employees and I would say they're definitely happier having an understanding of what is covered, what is not covered, what is the policy, what the policy covers etc. So it works for us from a HR perspective, because there are fewer questions and it works for them because they themselves have a lot more visibility. So the entire process is much more streamlined. There is no back and forth. There are no repositories of information to send and then look through. And if they do have any issues there's a straightforward support email that we can reach out to which resolves our issues.

With everything sitting on the platform it’s very simple and if not, I can reach out directly to my representative so it's pretty good.

How's that relationship between you and the person on our end to make sure that any queries or any issues are addressed?

I'll be honest, It's amazing. It's with the kind of demands that we have being in the service sector which is operating for 24 hours that means we have people that come in for work and they realize that they need something.

There are moments in terms of emergencies that we reach out to Bayzat representatives and they are always available, no matter what the time is, we're really thankful that that is available to us which makes us very happy. So we're thankful for getting that level of undivided attention and catering to our needs at any time of day.

It is truly more like working together for a solution rather than actually having a ready made solution.

That's not what we're looking for.

We know sometimes there are no solutions available at the time, but we can work together for a solution which is great as we know that not everybody has answers to everything.

I'll be honest, It's amazing. It's with the kind of demands that we have being in the service sector which is operating for 24 hours that means we have people that come in for work and they realize that they need something.

There are moments in terms of emergencies that we reach out to Bayzat representatives and they are always available, no matter what the time is, we're really thankful that that is available to us which makes us very happy. So we're thankful for getting that level of undivided attention and catering to our needs at any time of day.

It is truly more like working together for a solution rather than actually having a ready made solution.

That's not what we're looking for.

We know sometimes there are no solutions available at the time, but we can work together for a solution which is great as we know that not everybody has answers to everything.

Bayzat’s Insurtech has helped businesses such as Deliveroo in a number of ways.

First, it has helped them save money on their premiums by allowing them to shop around for the best rates.

Second, it has helped them streamline their claims process, making it faster and easier for them to get the reimbursements needed.

Finally, it has helped them better manage risk by managing their data and tools that they can use to make informed decisions about our coverage.

To find out more about opening up the possibilities of work life for your company

Contact us today